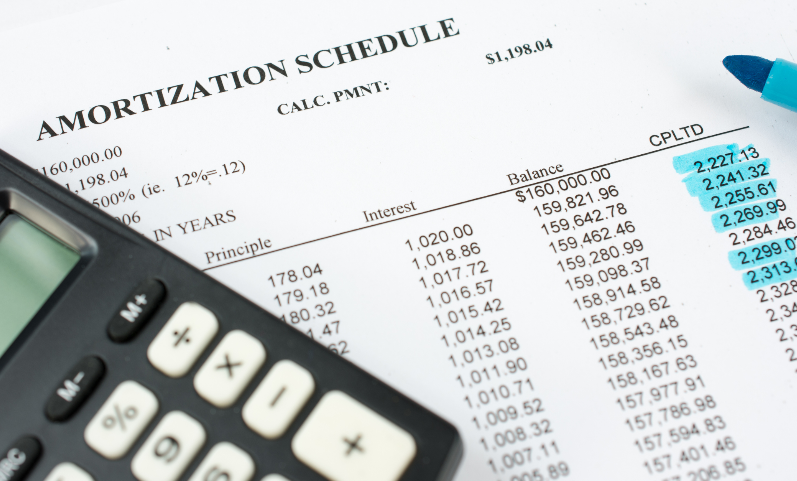

When home loans are taken,and the mortgage may be over a long period, the borrower need not wait so long to reply and do so when he/she has sufficient funds and not wait till the period of mortgage to come bay for the full and final payment. Here you can also refinance the loan; you can work out this if you want to still keep the investment for a longer term. Then there are personal loans that you might want to borrow, which also can be taken for a couple or a little more years and they can also be paid back installment basis,and you can chart out an amortization table for it too. You can opt for fixed monthly payments with a fixed rate of interest. You can now check the amortization schedule calculator .

How it works

The loans that you cannot claim amortization are as below

- Credit cards

- Interest only loans

- Balloon loans

When you start regularly borrowing on the same card, you have the choice of the amount you want to pay back each time, though there is a minimum amount you would have to pay or get penalized. This will not be there for amortization loan plans. These come under revolving debt. The interest-only loans can’t be amortized initially, and you would have to make do with the principal payments and then make voluntary payments in addition to the interest that has cost you for the loan. The balloon loans would like the borrower to make a big payment of the principal at the end of the life of the loan. The early payments will be smaller; sometimes you may end up refinancing the mortgage.

The borrower should also be interested to know that that the amortization has a role to play in refinancing a loan. For the refinancing part, you would again have to draw out another amortization table to get a clear picture of whether refinancing would be a good option on the loan you already have. The need to determine whether the whole process of refinancing the mortgage would be cost effective for the borrower is determined by the interest rate and the amount you still owe on loan.

negative amortization

There is the concept of negative depreciation which the borrower will be glad to note, when you end with deferred interest which is ultimately added to the principal of the loan amount, over some time the loan will increase, and you may end up with negative amortization. This can happen when their adjustable rate mortgages which are connected with interest-only loans. These may help to over significant monthly payments, but you will end up paying more of these with an increase in the amount of repayment. This because the principal will increase as the term of the loan moves on. Here the refinancing of the loan will help you get out of crises, which might help you get out of more significant debt and help to close the loan eventually.

The numbers that are put out on the spreadsheet won’t be a pleasing sight though it is the reality of the loan that you would have to take to buy that vehicle or home that you have been planning for so long.